- Home

- Knowledge Base

- Customers

- Customer Age Analysis and Statements

Customer Age Analysis and Statements

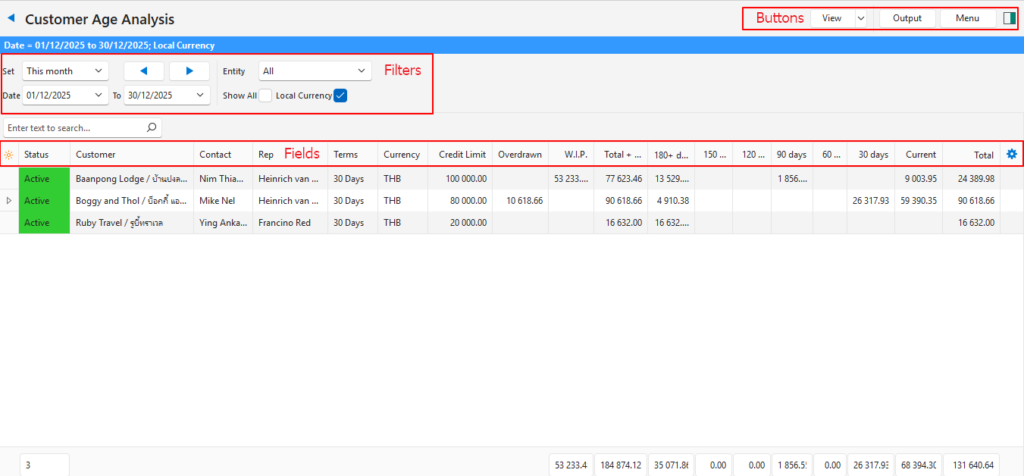

The Customer Age Analysis (CAA), also known as Debtors Age Analysis, is used by organisations to manage collections. The age analysis has columns that are divided into date ranges of current, 30, 60, 90, 120, and 180+ days. These date ranges are based on the calendar month and not necessarily the number of days in the month.

Credit limits are shown on the age analysis and there is a setting to allow Work in Progress to be shown.

A transaction appears on the age analysis once the Header Status is in an accounting status (the accounting checkbox is checked for that status).

The Customer Detailed Ledger can be accessed from the customer age analysis but is a separate module.

Navigation: Main Menu > Accounting > Customer Age Analysis

Settings

These settings affect which transactions are included in the totals that appear on the Customer Age Analysis.

| Setting | Setting Name | Description |

|---|---|---|

| Transaction Setting > Settings (tab) | Accounting > Enable Accounting | Customer Invoices and Credit Notes must have accounting enabled to appear on the age analysis and ledger. |

| Transaction Setting > Settings (tab) | Accounting > Sum Active Transactions to Work in Progress in Customer Age Analysis | The setting is added to applicable Transaction Types (e.g. Sales Orders). The checkbox in the Value column must be checked. If a transaction has a Status that falls in the Active group, the transaction is shown on the Customer Age Analysis as WIP. This feature helps organisations manage their customers’ credit limits. This setting should not be added to transactions that appear on the Customer Age Analysis by default (e.g. Customer Invoices, Credit Notes) because the amounts will be duplicated. |

| Transaction Setting > Status (tab) | Accounting | Transactions are only included in the Customer Age Analysis when they are in an Accounting status (i.e. the checkbox in the Accounting column is checked for the applicable Status). |

Interface Explained

The ageing on the Customer Age Analysis is based on applying customer receipts or credit notes to the oldest invoices first. It does not currently consider allocations.

Buttons Explained

| Button | Description |

|---|---|

| View | Generates a list of entries as per the selected data filters. |

| Arrow on View Button | Reset Data Filter > Resets all the data filters. |

| Output | Prints, previews or emails reports if Output Templates are created. Customer Statements are normally one of the templates and are emailed from the age analysis. Customer ledgers have different output options. |

| Menu | Views – Age Analysis – Detailed Ledger Settings – User Access Layout |

Filters Explained

- The Start Date applies to statements and the ledger. It has no effect on the age analysis.

- The End Date is the date for which the age analysis is generated.

- The age analysis dates are transferred to the ledger. However, any changes to the dates on the ledger are not transferred to the age analysis.

| Filter | Description |

|---|---|

| Set | Allows users to select a date from the dropdown list (e.g. No Date, Today, This year). |

| Navigational Arrows | Adjusts the date in the direction of the arrow. |

| Date … to … | Allows users to set their own Dates (based on the selection under Set). The To date defaults to today. |

| Entity | A dropdown list of Entities to select All or a specific Entity. |

| Show All | Checkbox. If checked shows all the customers, even those with zero balances. |

| Local Currency | Checkbox. If checked converts all the values to the local currency. |

Fields Explained

| Field | Description |

|---|---|

| ID | The system-generated number for the entry. |

| Status | The customer’s Status. |

| Customer | The customer’s Name |

| Code | The customer’s Code. |

| Contact | The name of the customer’s Accounts contact person. |

| Rep | The name of the Rep assigned to the customer. |

| Terms | The customer’s Terms. |

| Currency | The customer’s Currency. |

| Credit Limit | The customer’s Credit Limit. |

| Overdrawn | The sum of WIP and Total Amount Outstanding that exceeds the Credit Limit. |

| W.I.P. | The total value of Work in Progress as per the setting. |

| Total + W.I.P. | The total amount outstanding added to the work in progress. |

| 180+ days | The amount that has been outstanding for 6 months or more from the To date. |

| 150 days | The amount that has been outstanding for 5 months from the To date. |

| 120 days | The amount that has been outstanding for 4 months from the To date. |

| 90 days | The amount that has been outstanding for 3 months from the To date. |

| 60 days | The amount that has been outstanding for 2 months from the To date. |

| 30 days | The amount that has been outstanding for 1 month from the To date. |

| Current | The amount that represents transactions in the current month. |

| Total | The Total amount outstanding. |

| Widget | A sub-menu that can also be accessed by right clicking the entry: – Open Customer: Opens the customer’s contact form with limited functionality. – Open Detailed Ledger: Opens the customer’s detailed ledger. |

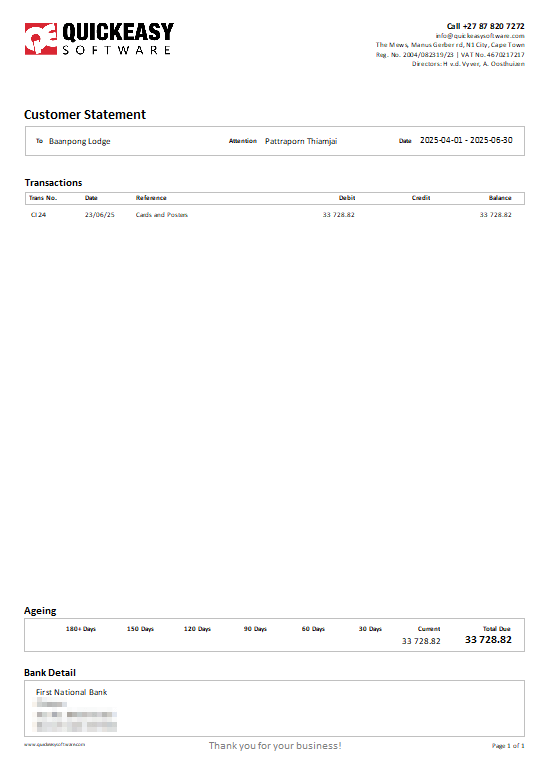

Customer Statements

- Customer Statements are sent from the age analysis.

- Below is an example of an included template which is accessed by clicking Output (button).

- When generating customer statements, an Entity must be selected because the heading, bank details and logo are picked up from the entity’s records. Only applies if there is more than one registered entity.

- Currently statements must be sent one at a time.