- Home

- Knowledge Base

- Transaction Types

- Transaction Type Settings

Transaction Type Settings

Before transactions can be captured, these steps must be completed:

- Create a Transaction Type for every transaction needed (e.g. Customer Invoices, Credit Notes, General Journal, Bank Payments) and complete the additional tabs:

- Choose the Settings.

- Create Statuses.

- Create Categories (optional).

- Create rules for copying the transactions and set user access for those rules (referred to as Copy Rules).

- Create or import forms (e.g. Invoices) that are applicable to the transactions (known as Output Templates).

- Set the User Access for the Transaction Type.

- Add the Transaction Type to the Menu.

Organisations may create as many Transaction Types as they want.

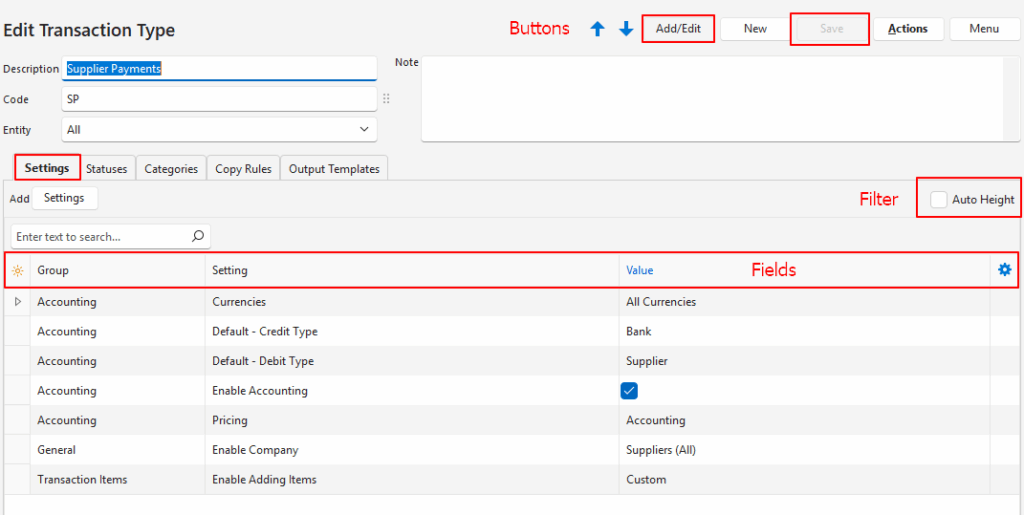

Navigation: Main Menu > Setup > Transaction Types > Double click a Transaction Type > Settings (tab)

Settings (tab)

- Each Transaction Type can have its own custom settings.

- Each setting has a default value. It is only necessary to add the setting to change the default value.

- When Settings (button) is clicked, only the settings that have not yet been added to the list are displayed. There is a checkbox to Show All settings.

To clear the value selected from a dropdown list in the Value column, select the blank space on the top row of the dropdown list.

Settings with Default as part of the name can be changed when entering a transaction. The selected value for the setting should be applicable to most transactions.

Settings Explained

| Field | Description | Default | When required |

|---|---|---|---|

| Accounting > Credit Account Filter (Enter string contained in Accounts > Lookup) | Option to limit the accounts that are displayed on the lookup by typing a word or phrase. The filter is case-insensitive. | Applicable to all transaction types that affect accounting. For example, if you prefix all sales accounts with SLS, and enter SLS in the Value column, then only the sales accounts are displayed when selecting an account to credit. | |

| Accounting > Credit Type | A dropdown list of Account Types for users to select one. The options are: – Customer – Supplier – Ledger | Applicable to all transaction types. Examples: Customer: Select for Credit Notes. (Cr Customer, Dr Sales) Supplier: Select for Supplier Invoices. (Cr Supplier, Dr Purchases or Inventory) Ledger: Select for Other Income, Sales, and VAT Refunds. (Cr Other Income, Dr Bank) | |

| Accounting > Currencies | Field to select which currencies apply to the transaction type. The options are: – Local Currency: The transaction type can only use the local currency. – Company Currency: The transaction type can use the customer or supplier’s currencies. – All Currencies: The transaction type can use all the currencies set up for the organisation. | Local Currency | Applicable to all transaction types. |

| Accounting > Debit Account Filter (Enter string contained in Accounts > Lookup) | Option to limit the accounts that are displayed on the lookup by typing a word or phrase. The filter is case-insensitive. | Applicable to all transaction types that affect accounting. For example, if you prefix all Cost of Sales Accounts with COS, and enter COS in the Value column, then only the Cost of Sales accounts are displayed when selecting an account to debit. | |

| Accounting > Debit Type | A dropdown list of Account Types for users to select one. The options are: – Customer – Supplier – Ledger | Applicable to all transaction types. Examples: Customer: Select for Customer Invoices (Dr Customer, Cr Sales). Supplier: Select for Supplier Debit Notes (Dr Supplier, Cr Purchases or Inventory). Ledger: Select for Expenses, Purchases, VAT Payments (Dr Expense, Cr Bank). | |

| Accounting > Default – Credit Account | A dropdown list of all the created Accounts as per the Chart of Accounts for users to select a default account. | Applicable to all transaction types where Accounting > Credit Type is Ledger and where the transaction should be posted to a specific ledger account. | |

| Accounting > Default – Debit Account | A dropdown list of all the created Accounts as per the Chart of Accounts for users to select a default account. | Applicable to all transaction types where Accounting > Debit Type is Ledger and where the transaction should be posted to a specific ledger account. | |

| Accounting > Default – Deposit % | Field to type the default Percentage Deposit customers must pay or that must be paid to suppliers. | 0 | Applicable to customer and supplier transactions. |

| Accounting > Default – Price includes VAT | A checkbox that is checked if the price includes VAT. Determines how VAT is calculated. – Exclusive (unchecked) = VAT is added to determine the VAT-inclusive price. – Inclusive (checked) = VAT is subtracted to determine the VAT-exclusive price. | Unchecked | Applicable to all transactions. |

| Accounting > Default – VAT Category (Input/Output) | Select a VAT Category from these options: – N/A – Output + (e.g. Customer Invoices) – Output – (e.g. Customer Credit Notes) – Input + (e.g. Supplier Invoices) – Input – (E.g. Supplier Debit Notes) | N/A | Applicable to all transaction types on which VAT is either charged or claimed. Affects whether the VAT Control account is debited (Input) or credited (Output) (i.e. how VAT is treated on the transaction). Example: Input + Cr Supplier: VAT inclusive amount Dr Expense: VAT exclusive amount Dr VAT Control: VAT amount Example: Output + Dr Customer: VAT inclusive Amount Cr Sales: VAT exclusive amount Cr VAT Control: VAT Amount Affects the VAT Reconciliation calculations: VAT Output = VAT Output + less VAT Output – (e.g. Customer Invoices less Customer Credit Notes). VAT Input = VAT Input + less VAT Input – (e.g. Supplier Invoices and Expenses less Supplier Debit Notes). |

| Accounting > Default – VAT Type | Select a default VAT Type for the transaction type from a dropdown list of all the created VAT types. | No VAT | Applicable to all transaction types on which VAT is either charged or claimed. |

| Accounting > Enable Accounting | A checkbox. If checked, accounting is enabled. If unchecked, transactions are created in the module and not posted to the Ledger. | Unchecked | Should be unchecked for transaction types that relate to internal procedures (e.g. Purchase Orders, Work Orders, Quotations, Sales Orders). Should be unchecked for transaction types that record inventory movements unless there are very few items held in stock. Should be checked for all other transaction types. Transaction types that have accounting enabled can be created from the ledger and do not have to be added to a menu. |

| Accounting > Enable Withholding Tax (WHT) | If checked, provision is made for withholding tax. | Unchecked | Applicable to personal-service type organisations. Supplier payments if tax must be withheld from payments to that type of organisation. Customer receipts if customers must withhold tax from their payments. |

| Accounting > Pricing | A dropdown list to select a pricing option: – None – Cost Price – Sell Price – Supplier Price – Accounting | Sell Price | Applicable to all transaction types. If a pricing option is not selected, an amount cannot be entered. Select Supplier Price for supplier transactions (e.g. Purchase Orders, Supplier Invoices). Select Sell Price for customer transactions (e.g. Quotations and Customer Invoices). Select Cost Price for Work Orders and inventory transactions (e.g. Goods Issued). Select Accounting Price for Bank Payments, Bank Receipts, and Journal Entries (e.g. Payroll, General Journal). If Items are used, the matching price Supplier, Sell, or Cost Prices must be filled in on the item’s Prices tab. |

| Accounting > Set Due Date from Credit Terms | Checkbox. If checked the credit terms are used to prefill due dates. | Unchecked | Applicable to customer and supplier transactions (e.g. invoices) that have payment due dates. |

| Accounting > Sum Active Transactions to Work in Progress in Customer Age Analysis | Checkbox. If checked customer transactions with Active statuses are shown on the Customer Age Analysis as work in progress. | Unchecked | Applicable to non-accounting customer transaction types (e.g. Sales Orders). |

| Accounting > Sum Active Transactions to Work in Progress in Supplier Age Analysis | Checkbox. If checked supplier transactions with Active statuses are shown on the Supplier Age Analysis as work in progress. | Unchecked | Applicable to non-accounting Supplier transaction types (e.g. Purchase Orders). |

| Calendar > Resource Calendar (Transaction Items) | Provides a dropdown list of calendar types to select the one applicable to the transaction. | Any transaction that involves a task that should be recorded on the organisation’s calendar. | |

| Calendar > Enable Date End (Enter Caption) | Allows users to specify a caption for the transaction’s start date on the calendar. | Any transaction that involves a task that should be recorded on the organisation’s calendar. | |

| Calendar > Enable Date Start (Enter Caption) | Allows users to specify a caption for the transaction’s end date on the calendar. | Any transaction that involves a task that should be recorded on the organisation’s calendar. | |

| Calendar > Set Quantity from Calendar (Duration between Start and End Dates | Checkbox. If checked the durations on transactions are automatically changed to the working hours between the end and start calendar dates. The quantity is rounded to the calendar’s smallest scale. Days are calculated on a check-in/check-out model: 12/10/25 – 13/10/25 = 1 day Transaction update method: Update Start Date: Qty is updated. Update End Date: Qty is updated. Update Qty: End Date is updated. | Any transaction that involves a task that should be recorded on the organisation’s calendar. | |

| Defaults > Default – Data Filter | The default display when a list of transactions for the transaction type is viewed. The options are: – Today – This Month – Pending – Active – Pending & Active | Pending & Active | Applicable to all transaction types. |

| Estimating > Convert Assembly (ASM) Items to Estimates | Checkbox. Checked: Assembly items are automatically converted to estimates when added to transactions that use estimating. This process automatically generates the Bill of Materials (BoM) and Routing necessary for production. Unchecked: Assembly items can manually be converted to estimates on transactions that use estimating. | Unchecked. | Applicable to transaction types that have estimating enabled. |

| Estimating > Enable Estimating | A dropdown list with the following options: – None: Estimating is not used. – Quotations: Estimating is used to quote for jobs. – Production: Enables the production planning modules for the transaction type. | None | Allows estimates to be created as line items on quotations, or work orders (production). |

| General > Add Items from the following Categories | This action adds items from the selected categories. Click Edit in the value column and select the categories. | Applicable to inventory, customer, and supplier transactions. Useful if multiple transaction types were created for the same function (e.g. work orders), to delineate which items apply to which transaction type. Unnecessary if only one transaction type is created to manage all the items. | |

| General > Add to Followers | A dropdown list of Follower options. Multiple categories can be selected: – N/A (automatically appears if no selection is made) – Contact (Transactions) – Contact (Accounts) – Rep – Assign To – User | N/A | Applicable to any transaction that someone wants to be notified of. Followers must be entered as Contacts or Users and have email addresses. |

| General > Contact Lookup | A dropdown list to select which Contact fields should be included when selecting a contact for a transaction. The options are: – Name – Name (Position) – Name (Location) – Name (Position & Location) | Name | Applicable to transactions where contact people are selected (e.g. customer and supplier transactions). |

| General > Enable Artwork | Checkbox. If checked artwork is enabled and can be uploaded to a line item on a transaction as an attachment. | Unchecked | Applicable to transactions for which estimating is enabled. |

| General > Enable Assets | Checkbox. If checked, users can select an asset to link the transaction to from a dropdown list. | Unchecked | Applicable to transactions that involve assets. The transactions depend on the type of business. Businesses that lease out or maintain assets would include this setting in most transactions. Business that only occasionally buy assets would including this setting only on transactions like supplier invoices. When transactions are copied, the assets are also copied if both the source and target transactions have assets enabled. |

| General > Enable Company | Users can select an access option as follows: – N/A – Customers (All) – Customers (Active) – Suppliers (All) – Suppliers (Active) | N/A | Applicable to all transaction types that involve customers or suppliers. Customers (All) and Suppliers (All) should be used for transactions that involve payments so that all the payments can be recorded. Customers (Active) and Suppliers (Active) should be used for transactions that involve purchases or sales to stop doing business with suspended customers or suppliers. |

| General > Enable Delivery Address | A checkbox. If checked, the Delivery Address is enabled. | Unchecked | Applicable to customer transactions (e.g. Customer Invoices, Delivery Notes). |

| General > Enable Due Date (Enter Caption) | Type a caption if the Due Date field should be added to the transaction (e.g. Due Date). | Applicable to inventory, customer, and supplier transactions. Optional setting that can be customised. Normally used to indicate the date on which production should finish the job. | |

| General > Enable Item Status | Checkbox. If checked transaction items can have statuses. If unchecked, only the overall transaction has a status (referred to as the transaction header status). | Unchecked. | All transactions. |

| General > Enable NCR (Problem) | Checkbox. If checked, transactions can be marked as problem transactions for NCR purposes. | Unchecked | Normally applied to Purchase Orders (to re-order supplies) and Work Orders (to remake faulty goods). |

| General > Enable Proposals | Checkbox. If checked, proposals can be created from the transaction. | Unchecked | Applicable to Quotations. |

| General > Enable Required Date (Enter Caption) | Type a caption if the Required Date field should be added to the transaction (e.g. Req. Date). | Applicable to inventory, customer, and supplier transactions. Optional setting that can be customised. Normally used to indicate the date on which customers require the goods. | |

| General > Enable Staff | Allows an organisation to assign transactions: – None: Transactions are not assigned. – All: Transactions can be assigned to Users, and a Rep can be selected. – Rep: Transactions can only be linked to a Rep. – Assign To: Transactions can only be assigned to a User. | None | Applicable to inventory, customer, and supplier transactions. |

| General > Enable Timekeeping | Allows timekeeping to be tracked against the transaction. | Unchecked | Applicable to inventory, customer, and supplier transactions that involve tasks or projects that are tracked. |

| General > Enable Version Numbers | A checkbox. If checked version numbers are enabled (e.g. Quotation versions). | Unchecked | Applicable to inventory, customer, and supplier transactions but normally only used for quotations. |

| General > Reference Lookup | A field to type Reference lookup lists. | Applicable to any transaction where a lookup list is needed for the reference field (e.g. to speed up input, or to ensure consistency). | |

| General > Transaction Number | Specifies how transaction numbers are allocated when the transaction type is first created. The options are: – Edit: Allows users to edit/enter numbers only (e.g. for supplier invoices). A warning is displayed on the red warning bar if a duplicate transaction number is entered. – Generate: The system automatically generates numbers in sequence. – Generate (Entity): The system automatically generates numbers in sequence for each entity. | Generate | Applies to all transactions. Customer documents: Generate or Generate (Entity) ensures invoices and credit notes are issued in sequence. Supplier documents: Edit allows users to type the supplier’s document number in the document number field. (The number can also be typed in the reference field.) |

| Inventory > Default Inventory Location (Production Materials) | Allows users to select a default inventory location for production materials. (Inventory locations are created under Entities.) | Applies to transactions linked to production (e.g. Work Orders). | |

| Inventory > Default Inventory Location (Transaction) | Allows users to select a default inventory location for the transaction type. (Inventory locations are created under Entities.) | Applies to all transactions that are used to manage inventory. | |

| Inventory > Enable Resolves | Allows users to specify what must happen to inventory items. Multiple options may be selected from this list: – Purchase: The inventory must be purchased. This resolve is used for copying transactions and does not affect inventory. – Produce: The inventory must be produced. This resolve is used for copying transactions and does not affect inventory (e.g. Work Orders). – Reserve: The inventory is reserved for an order (e.g. Sales Orders). – Issue: The inventory is issued to a job or customer (e.g. Work Orders, Sales Orders, Customer Invoices). – On Order: The inventory has been ordered, but not yet received (e.g. Purchase Orders, Work Orders). – Receive: The inventory has been received (e.g. Supplier Invoices, Work Orders). | N/A | Applies to all transactions in which inventory items are used with the exception of Stock Adjustments which has its own setting. |

| Inventory > Enable Stock Adjustment | Checkbox. If checked, the transaction is used for stock adjustments when a stock count is done. The following fields are enabled: In Stock: Displays the quantity at the end of the day of the transaction’s date. Count Qty: A column to enter the counted quantity. Qty: The amount by which stock is adjusted (counted quantity less what is in stock). | Unchecked | Should only be applied to the transaction used to record stock adjustments when a stock take is performed. |

| Inventory > Update Supplier Prices on linked Items | Checkbox. If checked the Supplier price is updated when the transaction’s status is changed to a Complete status. The Supplier Price is matched on Supplier, Unit and Currency. | Unchecked | Applies to supplier transactions such as supplier invoices. |

| Mobile > Enable in Mobile App | Checkbox. If checked, the transaction can be accessed from the mobile app. | Unchecked | Applies to production and stock-movement transactions that can be managed from the mobile app. |

| Production > Transaction – Goods Issues | Checkbox. If checked the transaction type is used for goods issued (i.e. identifies the transaction type used to Issue materials from Production > Materials View). | Unchecked | Applies if production is used. Only applicable to the specific Goods-Issued transaction type. |

| Production > Transaction – Purchase Orders | Checkbox. If checked the transaction type is used for purchase orders (i.e. the transaction type used to Purchase Materials from Materials View and Outwork from Outwork View). | Unchecked | Applies if production is used. Only applicable to the specific Purchase-Order transaction type. |

| Transaction Items > Enable Adding Items | Allows users to specify which type of items can be added to a transaction. The options are: – None: No items are added, only the header information is displayed. This option should be used sparingly and not for accounting transactions because there will be no fields for amounts. – All: Users may add items and custom items. – Custom: Users my only add custom items. Typically used for ledger transactions. – Items: Users may only add items. They may not add custom items. Typically used for Invoicing, credit and debit notes. All the buttons to add items are still displayed. The features that are disabled return an error message if clicked. | All | All transactions. |

Incorrect Mix of Settings Warnings

The warning is displayed on an orange warning bar when selecting settings for the Transaction Type. See Copy Rules for additional warnings.

| Warning | Applicable Settings | Problem | Solution |

|---|---|---|---|

| Customer (Company) and Supplier Price | General > Enable Company Accounting > Pricing | Customer transactions such as Quotations, Sales Orders, and Customer Invoices should use Sell Prices. | If General > Enable Company = Customer Change Accounting > Pricing = Sell Price (invoices) or Accounting Price (payments). If General > Enable Company = Supplier Change Accounting > Pricing = Supplier Price (invoices) or Accounting Price (payments). |

| Supplier (Company) and Sell Price | General > Enable Company Accounting > Pricing | Supplier transactions such as Purchase Orders and Supplier Invoices should use Supplier Prices. | If General > Enable Company = Customer, Accounting > Pricing = Sell Price. If General > Enable Company = Supplier, Accounting > Pricing = Supplier Price. |

| Cost Price and Price includes VAT | Accounting > Default – Price Includes VAT Accounting > Pricing | Cost Prices are recorded VAT exclusive; therefore, they must be entered as VAT exclusive. | For work orders, or sales orders, uncheck the block next to the setting Accounting > Default – Price Includes VAT. For other transactions, check if the correct price is selected. |

| Cost Price can only be selected with No VAT | Accounting > Default – VAT Type Accounting > Pricing | Cost Prices are used for internal transactions. VAT is not applicable to them. | If the Cost Price is correct, select No VAT as the default VAT Type. If VAT is applicable, select a different option under Pricing (e.g. Sell Price for Customer Invoices, or Supplier Price for Supplier Invoices). |

| Convert Assembly (ASM) Items to Estimates can only be used if Estimating is enabled | Estimating > Enable Estimating Estimating > Convert Assembly (ASM) Items to Estimates | Estimating is not enabled, but the checkbox to Convert Assembly (ASM) Items to Estimates is checked. | Enable Estimating by selecting Quotations or Production from the dropdown list. or Uncheck the checkbox next to the setting Convert Assembly (ASM) Items to Estimates. |

| Debit and Credit types cannot both be assigned to a Customer or Supplier | Accounting > Credit Type Accounting > Debit Type | You cannot create direct transactions between two customers, two suppliers, or between a customer or supplier. Either the Debit or Credit Type must be a ledger account. | To transfer an invoice, issue a credit or debit note, and create a new invoice. To transfer a payment or receipt, cancel the wrongly allocated payment or receipt and enter a new one. To offset a customer and supplier account, use an accrual or suspense account (e.g. Cr Customer, Dr Suspense and Dr Supplier, Cr Suspense.) |

Settings Tutorials

These tutorials explain how to manage the settings for Transaction Types.

How to Add Transaction Settings

- Navigate to Main Menu > Setup > Transaction Types > Double-click a Transaction Type > Settings (tab).

- Click Add/Edit (button) unless it is greyed out.

- Click Settings (button) next to Add.

- Check any settings that appear on the list.

- Note: Settings that have already been added are not on the list unless you check the checkbox next to Show All.

- If the default values meet your needs, you do not have to add the setting.

- Click any setting for which you want to change the default value.

- Click Add/Update (button)

- Confirm that you want to add the setting.

- Close the popup with the settings (it remains open for you to select more settings).

- Edit the settings that were added by selecting or typing an option in the Value column.

How to Edit Transaction Settings

- Navigate to Main Menu > Setup > Transaction Types > Double-click a Transaction Type > Settings (tab).

- Click Add/Edit (button) unless it is greyed out.

- Click the Value column next to the setting you want to edit.

- Make the necessary changes.

- Click Save (button).

How to Delete Transaction Settings

Deleting a setting removes it from the list of settings on Settings (tab). The setting reverts to its default value and can be added again if needed.

- Navigate to Main Menu > Setup > Transaction Types > Double-click a Transaction Type > Settings (tab).

- Right click the Setting to delete and select Delete from the context menu.

- Confirm that you want to delete the setting.