- Home

- Knowledge Base

- Transaction Type Examples - Suppliers

- Setup Example – Supplier Journals

Setup Example – Supplier Journals

- Supplier Journals are used to debit Supplier accounts with ledger entries.

- For example:

- To debit a supplier account with a settlement discount received.

- To record an offset payment (where a customer and supplier is the same company and their accounts are offset against each other).

This page provides an example of a Transaction Type setup for Supplier Journals.

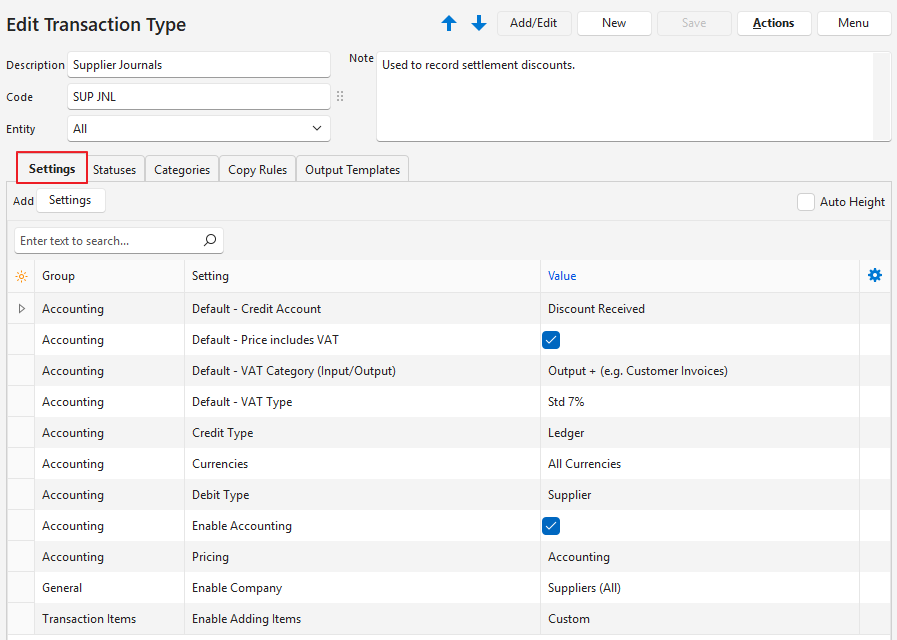

Header

- Description: Supplier Journal

- Code: SUP JNL

- Entities: All

Settings (tab)

- This section lists the compulsory and optional settings that can be used to customise Supplier Journals.

- Settings with Default as part of the name, can be changed when capturing a transaction.

| Field | Description | Value | When Required |

|---|---|---|---|

| Accounting > Currencies | Field to select which currencies apply to the transaction type. The options are: – Local: The transaction type can only use the local currency. – Company Currency: The transaction type can use the customer or supplier’s currencies. – All: The transaction type can use all the currencies set up for the organisation. | All | If supplier accounts are in more than one currency. |

| Accounting > Default – Credit Account | A dropdown list of all the created Accounts for users to select a default account. | Discount Received | Always |

| Accounting > Credit Type | A dropdown list of Account Types for users to select one. The options are: – Customer – Supplier – Ledger | Ledger | Always |

| Accounting > Debit Type | A dropdown list of Account Types for users to select one. The options are: – Customer – Supplier – Ledger | Supplier | Always |

| Accounting > Default – Price includes VAT | A checkbox that is checked if the price includes VAT. Determines how VAT is calculated. – Exclusive (unchecked) = VAT is added to determine the VAT-inclusive price. – Inclusive (checked) = VAT is subtracted to determine the VAT-exclusive price. | Check the checkbox. | Always |

| Accounting > Default – VAT Category (Input/Output) | Select a VAT Category from these options: – N/A – Output + (e.g. Customer Invoices) – Output – (e.g. Customer Credit Notes) – Input + (e.g. Supplier Invoices) – Input – (E.g. Supplier Debit Notes) | Output + | Always if you are registered for VAT. |

| Accounting > Default – VAT Type | Select a default VAT Type for the transaction type from a dropdown list of all the created VAT types. | Select the VAT Type for VAT Standard. | Always if you are registered for VAT. |

| Accounting > Enable Accounting | A checkbox. If checked, accounting is enabled. If unchecked, transactions are created in the module and not posted to the Ledger. | Check the checkbox. | Always |

| Accounting > Pricing | A dropdown list to select a pricing option: – None – Cost Price – Sell Price – Supplier Price – Accounting | Accounting | Always |

| Defaults > Default – Data Filter | The default display when a list of transactions for the transaction type is viewed (e.g. This Month, Pending). | Select an option from the dropdown list. | The default value is Pending & Active. Add this setting if you want a different default filter. |

| General > Enable Company | Users can select an access option as follows: – N/A – Customers (All) – Customers (Active) – Suppliers (All) – Suppliers (Active) | Suppliers (All) | Always |

| General > Reference Lookup | A field to type Reference lookup lists. | Click the Value column. Type a reference one entry per line. Check Auto Height to show the full list. | If you want to create a lookup list for the reference field. |

| Transaction Items > Enable Adding Items | Allows users to specify which type of items can be added to a transaction. The options are: – None: No items are added, only the header information is displayed. This option should be used sparingly and not for accounting transactions because there will be no fields for amounts. – All: Users may add items and custom items. – Custom: Users my only add custom items. Typically used for ledger transactions. – Items: Users may only add items. They may not add custom items. Typically used for Invoicing, credit and debit notes. All the buttons to add items are still displayed. The features that are disabled return an error message if clicked. | Custom | Always |

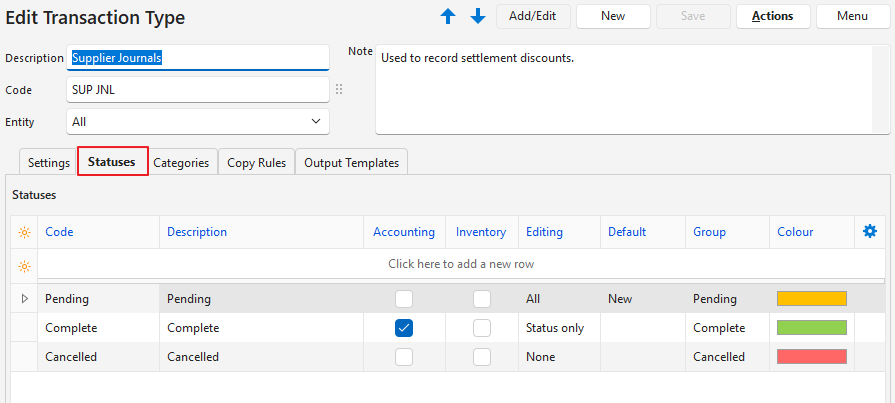

Statuses (tab)

- You may create an unlimited number of Statuses.

- However, there are only four Status Groups (Pending, Active, Complete, and Cancelled).

- The first status should allow editing.

- The final status should ideally not allow editing.

- If the setting Accounting > Enable Accounting is checked, at least one status should have the Accounting column checked.

- If Inventory is used, at least one status should have the Inventory column checked.

- If editing is allowed when the inventory or accounting columns are checked, any accounting or inventory reports should be considered provisional.

Categories (tab)

- Categories are used to sort records.

- The categories you choose should be meaningful to your business.

- Using categories is optional but recommended.

- Categories can be copied from another transaction type. The existing categories are replaced by the copied categories.

No Categories.

Copy Rules (tab)

- Copy Rules determine the circumstances under which transactions may be copied.

- Although there are two transactions involved in the copy, you only need to create one copy rule.

- User access must be set for each copy rule.

- You can automate copying transactions by selecting a Trigger status.

- Columns that were hidden in the screenshot were left blank or unchecked.

No Copy Rules.

Output Templates (tab)

- Output templates are the forms you need to print, preview or email a transaction (e.g. invoices).

- Default templates are included which will automatically include your company name, logo, and bank details as filled in on the Output tab of a registered Entity.

- You may edit these templates to include or exclude information.

- You may also create your own forms and templates from scratch.

No Templates.